In India many people save money in banks and fixed deposits, but the interest they earn on these accounts is taxable. To keep all the interest without any tax deductions, you can fill out Forms 15G and 15H.

Under section 194A of Income Tax, Banks have to deduct TDS (tax deducted at source) when your interest income exceeds certain limits, such as Rs. 40,000 per year for individuals below 60 years of age (Rs. 50,000 for senior citizens). This limit is calculated by adding up the interest from all your deposits in the bank.

However, if your total income is below the taxable limit, you can submit Form 15G (for individuals below 60 years of age) or Form 15H (for senior citizens) to the bank. By doing this, you’re telling the bank not to deduct any TDS from your interest income.

Current TDS rate on Bank deposits is 10% for Indian residents if PAN is submitted at the Bank and 20% if PAN is not available in the account.

In this article we will understand what are Form 15G & 15H ?. Important features of Form 15G & Form 15H.? When and who should submit Form 15G & 15H.

How to fill Form 15G & 15H offline & Online?

Table of Contents

What is FORM 15G?

Form 15G is a special form of declaration submitted by a Fixed Deposit holder to their bank.

With the help of the 15G form, a depositor declares his annual income to the bank and requests that the bank not deduct the TDS on the interest income earned for the fiscal year.

Important Features of Form 15G

- PAN is mandatory to fill Form 15G.

- Any resident individual taxpayer with age below 60 years can submit Form 15G.

HUF and Trust can also submit Form 15G.

- A company or any Firm can not submit Form 15G.

- The total receivable interest income in the financial year should be less than the minimum taxable income of Rs 2.5 lakhs.

- Only a resident of India can submit form 15G.

- When your taxable income does not result in a tax liability for the fiscal year, you are eligible to use the Form 15G.

- Taxpayers have to fill 15G form to all Banks, where they have deposit accounts.

What is Form 15H?

Form 15H is a form of declaration submitted by any Senior Citizen account holder, This form is submitted to avoid the TDS deduction on the interest income earned from investments in Fixed deposits and Recurring Deposits.Form 15H is a part of Section 197A, Subsection 1C of the Income Tax Act, 1961

With the help of Form 15H, Senior citizens will get full interest on their deposits without any tax deductions.

Important features of Form 15H

- PAN is mandatory to fill Form 15H

- Only a senior citizen with age 60 or above can fill Form 15H

- Basic exemption limit for senior citizen is Rs. 50000/-

- Form 15H should be submitted to all the banks where the taxpayer has deposit accounts.

Exemption Limit for Form 15G and Form 15H

| Type of Customer | Age | Form Type | Basic Exemption Limit (Rs) |

| Individual | Below 60 years | 15G | 2.5 Lakhs |

| Senior Citizen (Individual) | 60 years and above. | 15H | 5 Lakhs |

| Other than Individual (i.e. Trust, Association, Club, HUF and Society ) | Not Applicable | 15G | 2.5 Lakhs |

Who is eligible to submit Form 15G and 15H?

Example to understand that who can submit Form 15G & Form 15H

With the help of this example, you can easily understand the eligibility for Form 15G and Form 15H

| Age | 30 years | 50 years | 62 years |

| Salary | Rs. 120,000 | Rs. 120,000 | – |

| Pension | – | – | Rs 120,000 |

| FD interest income | Rs. 105,000 | Rs. 260,000 | Rs 280,000 |

| Total income before Section 80 deductions | Rs. 2,25,000 | Rs. 710,000 | Rs 400,000 |

| Deductions under Section 80 | Rs. 24,000 | Rs. 130,000 | Rs 100,000 |

| Taxable income | Rs. 2,01,000 | Rs. 5,80,000 | Rs 300,000 |

| Minimum exempt income | Rs. 2,50,000 | Rs. 2,50,000 | Rs 500,000 |

| Age | Below 60 | Below 60 | Above 60 |

| Tax on total income is Nil | Yes | No | Yes |

| Interest income is less than the basic exemption limit | Yes | No | N/A |

| Eligibility for Form 15G/15H | Form 15G | Not Eligible | Form 15H |

In the first column : If your age is 30 years and your total income is less than the minimum exempt limit of 2.5 lakhs and In this case your Interest income is more than 40000/-, So you are eligible to submit Form 15G.

In the second column : If you are 50 years old and your total interest income exceeds the maximum tax-exempt income limit of Rs 2.5 lakhs, you cannot use Form 15G. In other words, this form is not applicable to you because your income is higher than the allowed limit for tax exemption.

In the third column : if you are 62 years old and your interest income exceeds Rs 2.5 lakhs, you are eligible to use Form 15H. This is because your interest income is below the maximum exempt income limit of Rs 5 lakhs for your age. Therefore, you can submit Form 15H to avoid TDS deductions on your interest income.

When to submit form 15G and Form 15H?

Ideally, it should be filled at the beginning of the financial year. If you are opening a fresh deposit in any bank, you should submit Form 15G/H at the time of opening the deposit.

Submitting 15G/H ensures that the bank will not deduct any TDS on your interest income.

Forget to Submit Form 15G & Form 15H, What to do now?

Sometimes people may forget to submit FORM 15G / 15H. If your TDS got deducted by the Bank due to non submission of Form 15G/ 15H. You have two ways

- Submit Form 15G/15H immediately : Usually, banks deduct TDS on a quarterly basis. If your TDS was deducted for this quarter, you should immediately submit the FORM 15G/ 15H to avoid any deduction in the remaining financial year.

- File your Income Tax return : You can claim your TDS by filing your Income Tax. All TDS which were deducted on your PAN will appear in your Form 26AS. It also includes the TDS amount deducted by your Bank.This amount can be adjusted against your total tax liability for that financial year. If you have been eligible to submit Form 15G / 15H, You can claim your deducted TDS.

Apart from Banks, Form 15G / 15H are also used in following situations

1. TDS on EPF Withdrawals : If someone wants to withdraw EPF balance before completing Five years of service, In that case TDS is applied with rate of 10% (if PAN is available) & 34.606% (if PAN is unavailable). EPFO will deduct the TDS if withdrawal amount is more than Rs. 50000/-

In this situation one can submit a 15G / 15H form to request the EPFO department not to deduct TDS.

2. TDS on corporate bond income : If Income from corporate bond is more than Rs. 5000, you can submit Form 15G/ 15H to the issuer requesting non deduction of TDS.

3. TDS on Life Insurance amount receipt : Receipt of payment of a Life insurance policy including the bonus amount on maturity exceeds INR 1,00,000, then TDS is applicable to them under section 194DA.

You can submit Form 15G / 15H to the Insurance company.

4. TDS on post office deposits : TDS is applicable on Post Office deposits also. You can submit Form 15G/ 15H at the post office to avoid TDS.

5. TDS on rental income : If you are getting rent from any company or institution which is more than Rs. 2.4 Lakhs yearly, then 10% TDS is applicable. This TDS is deducted by your tenant company. In that case, you can submit Form 15G / 15H to avoid TDS deductions.

Difference between Form 15G and Form 15H

| Parameter | Form 15G | Form 15H |

| Who is eligible to file these forms? | Any Indian resident below 60 years of age,Hindu Undivided Family (HUF),Trusts | Any India resident aged 60 years or above |

| When should you submit these forms? | You can file these forms if your total taxable income is below Rs 2.5 lakhs, or if the interest you received is your only income for the financial year, or if the interest payment you received is below Rs 2.5 lakhs | Total taxable income is below Rs 5 lakhs Interest received is the only income for the financial year.& Interest payment is below Rs 5 lakhs |

| Reason for submitting these forms? | Save TDS on interest payments | Save TDS on interest payments |

| Where to submit this form? | BanksEPFOwith a Lessee who is a Corporate or AOPBond issuer | BanksPost-OfficeEPFOwith a Lessee who is a Corporate or AOPBond issuer |

| Validity | Valid for one financial year | Valid for one financial year |

| Where can you obtain these forms? | Banks, Post Offices, Insurers, Income Tax website | Banks, Post Offices, Insurers, Income Tax website |

| Compulsory document | PAN | PAN |

How to Fill Form 15G / 15H?

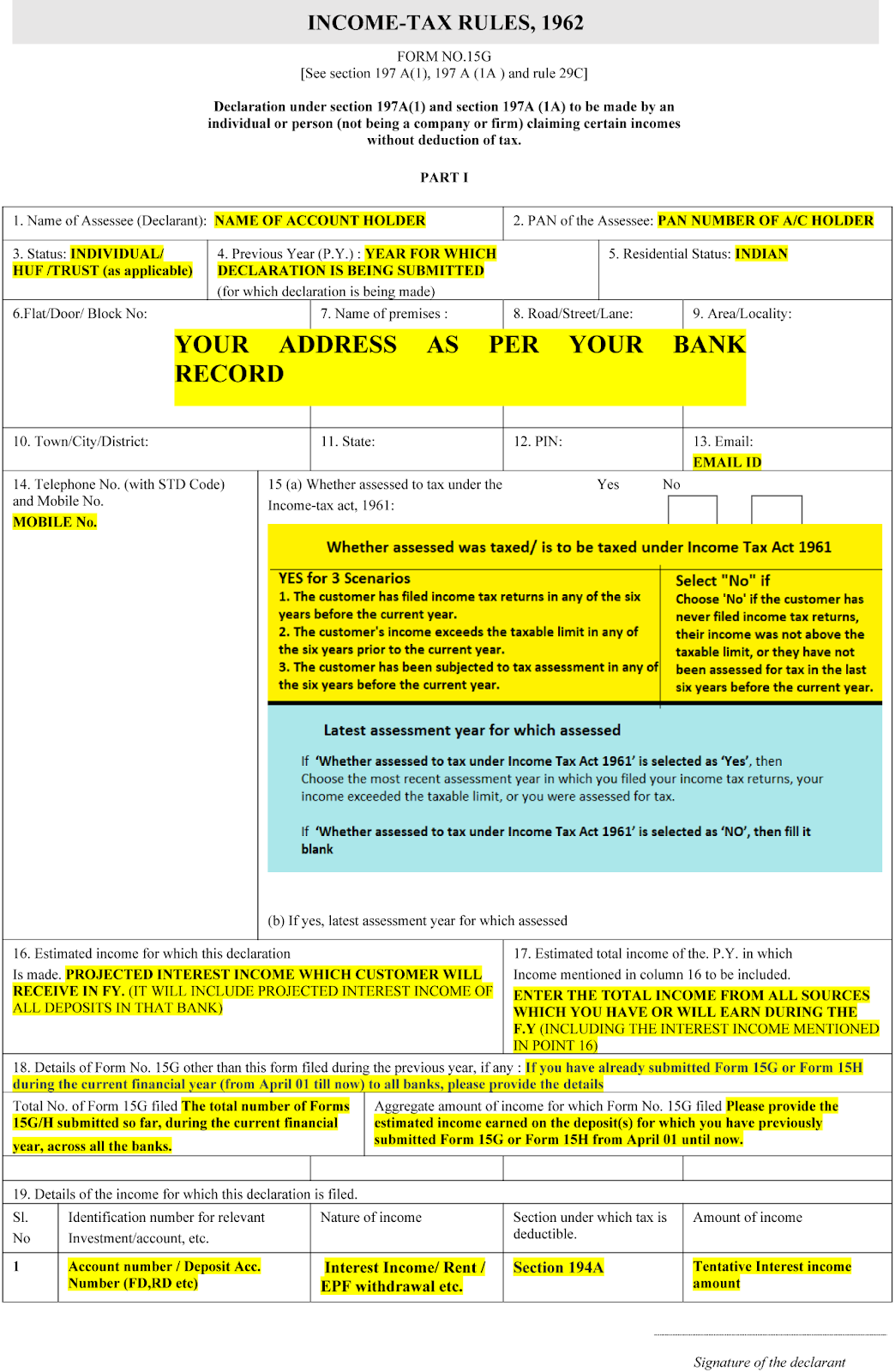

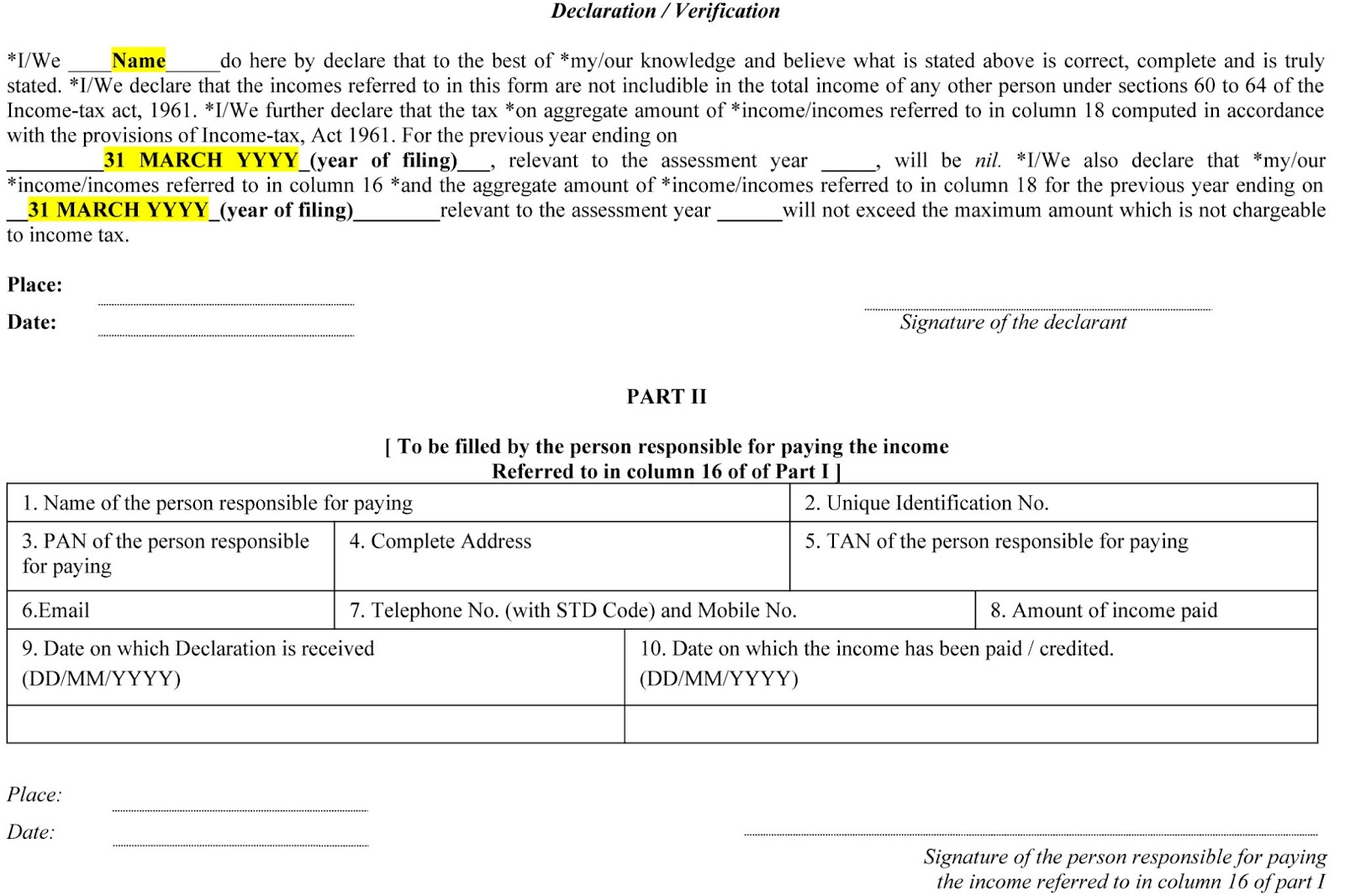

Sample of 15G / 15H form is given below. In this example, you will learn what details to be filled in the columns.?

Point wise details to be filled

- Name : Name of the account holder

- PAN of the account holder

- Status : Individual / HUF / Trust

- Previous year : Year for which declaration te be made

- Resident : Indian

- To point 12 is for address

13. Email id

14. Mobile number

15. (a) Whether assessed was taxed/ is to be taxed under Income Tax Act 1961

| YES for 3 scenarios | NO |

| 1. The customer has filed income tax returns in any of the six years before the current year. | Choose ‘No’ if the customer has never filed income tax returns, their income was not above the taxable limit, or they have not been assessed for tax in the last six years before the current year. |

| 2. The customer’s income exceeds the taxable limit in any of the six years prior to the current year. | |

| 3. The customer has been subjected to tax assessment in any of the six years before the current year. |

15. (b) Latest assessment year for which assessed

If “Whether assessed was taxed/ is to be taxed under Income Tax Act 1961” is selected as ‘YES’, Then choose the most recent assessment year in which you filed your income tax returns, your income exceeded the taxable limit, or you were assessed for tax.

If “Whether assessed was taxed/ is to be taxed under Income Tax Act 1961” is selected as ‘No’, then leave it blank.

FAQ – Form 15G and 15H

What is form 15G?

Form 15G is a special form of declaration submitted by a Fixed Deposit holder to their bank.

With the help of the 15G form, a depositor declares his annual income to the bank and requests that the bank not deduct the TDS on the interest income earned for the fiscal year.

Who is eligible for 15G?

Indian resident age less than 60 year, If total tax liability calculated on total taxable income for the applicable Financial Year is zero.

What is form 15G benefit?

By filling Form 15G, TDS will not get deducted on your interest income.

What is income limit for Form 15G?

Maximum exempt limit is 2.5 Lakhs per annum for F.Y 2023-24

What is the interest limit for 15G?

Rs. 40000 a year, which includes cumulative interest amount of all deposits.

How much TDS do I pay on FD 15G?

Current TDS rate on Bank deposits is 10% for Indian residents if PAN is submitted at the Bank and 20% if PAN is not available in the account. If you submit Form 15G, Then no TDS will be deducted by Bank.

Is 15G compulsory?

YES, if you do not want TDS deduction on your interest income.

Where is 15G applicable?

Applicable on Bank deposits, Rent received from Institution or corporate, Withdrawal of EPFO

Who fills Form 15G for PF withdrawal?

Person who is withdrawing PF amount before completion of 5 years of service, In this case TDS is applicable for amount more than Rs. 50000/-

What is difference between 15G and 15H?

Both 15G and 15H are used as declarations for non-deduction of TDS. Form 15G is used for people aged less than 60 years.

Form 15H is used for people aged 60 years or more.

When should we submit 15G?

If your Total interest income is above Rs. 40000 and your total taxable income comes under no tax slab.

Can a NRI submit Form 15G/ 15H?

No, only resident Indian can submit Form 15G/15H

Will the filing of Form 15G/Form15H mean that interest income is not taxable?

No, filling out Form 15G and 15H simply indicates that your estimated total taxable income for the previous year will be below the maximum exempt limit. However, if your actual total taxable income surpasses this limit, you will be required to pay tax on it, including the taxable portion of interest income exceeding the exempt limit of Rs 40000/-

Should I submit Form 15G/ Form 15H to all branches of my bank?

Yes. you should submit Form 15G / 15H to all the banks, where you have any Fixed deposits & cumulative interest income is more than Rs. 40000

What happens if I have submitted Form 15G/Form 15H but I also have taxable income?

By the end of the financial year, you will have to pay taxes on your overall income, which will include the tax on your interest earnings as well.

What is the penalty for a wrong declaration?

Providing wrong information on Form 15G or 15H can lead to penalties under section 277 of the Income Tax Act, 1961, including fines and imprisonment. If you don’t disclose the income received without TDS in your income tax return after submitting the form, it may be considered as tax evasion.

The penalties for tax evasion can range from six months to seven years of imprisonment for amounts exceeding Rs 25 lakhs, and three months to two years of imprisonment for other amounts.

Are Forms 15G or Form 15H an alternative to ITR?

No, Forms 15G and 15H are not an alternate for your yearly ITR. These forms are simply declarations for individuals with low income to simplify the process. However, you still need to file your ITR to complete your tax assessment and potentially receive any tax refunds you’re eligible for.

Related Article : How Positive Pay Works?