Introduction Integrated Ombudsman Scheme : In the dynamic landscape of the Indian economy, the banking sector plays a vital role as its backbone. Technological advancements and innovative banking methods have contributed to the ease and strength of the system. However, banks continue to shoulder a significant burden, leading to instances of disputes between customers and banks.

With the exponential growth of UPI (Unified Payments Interface) and digital payments, complaints related to these services have also surged. Additionally, the vast NBFC market has witnessed its fair share of customer disputes. Notably, disputes concerning UPI wallets like Paytm and PhonePe have become more prevalent due to the surge in transaction volumes. To address these challenges and ensure customer satisfaction, the Reserve Bank of India (RBI) introduced the Banking Ombudsman scheme.

In this article we will understand about the RBI Banking Ombudsman schemes | We will understand about the Integrated Banking Ombudsman Scheme. Also we will understand the step by step process to file complaint against banks, NBFCs and Digital wallets like Paytm/Phonepe etc. (Digital wallets are also called as Payment System Operators)

Table of Contents

Before November 2021, There were three different schemes made available by RBI for grievances redressal. Details are mentioned below

Banking Ombudsman Scheme 2006 : Banking Ombudsman scheme was first launched by RBI in 1995 to provide a forum for bank customers for resolution there complaints related to Banking services.

Then it was revised in 2002. Then again it was modified in 2006, and the scheme was renamed as Banking Ombudsman scheme 2006.

Ombudsman Scheme for Non-Banking Financial Companies (NBFCs), 2018 : This scheme was launched on February 23, 2018 for redressal of complaints against NBFCs registered with RBI under section 45-IA of RBI act 1934.

Ombudsman Scheme for Digital Transactions, 2019 : This scheme was introduced by RBI in 2019. This scheme provides a complaint redressal mechanism relating to the deficiency in customer services in digital transactions conducted through non bank entities regulated by RBI.

In November 2021,RBI has integrate all these three Ombudsman scheme into one scheme, This new scheme will be called as “Integrated Ombudsman Scheme 2021”

What is the Integrated Ombudsman Scheme 2021?

Recognizing the need for an integrated approach to resolve consumer complaints effectively, the RBI introduced the Integrated Ombudsman Scheme in 2021. This scheme aims to consolidate the existing ombudsman frameworks into a single, unified platform, providing a streamlined process for dispute resolution.

This new scheme will provide a platform to raise customer complaints related to Banks, NBFCs & Digital payments from a single portal.

Key Features of the Integrated Ombudsman Scheme

- Enhanced Accessibility: The scheme ensures easy access for consumers by providing online complaint submission and tracking facilities.

- Expanded Jurisdiction: The integrated scheme covers various financial institutions, including banks, non-banking financial companies (NBFCs), and payment system providers, among others.

- Uniformity in Resolution Process: Standardised procedures and guidelines are followed to ensure consistent and fair resolution of complaints across all sectors.

- Empowering Consumers: The scheme empowers consumers by offering them a convenient and cost-effective avenue to address their grievances.

- Proactive Redressal: The ombudsman has the authority to take action against any financial institution in case of systemic issues affecting a large number of consumers.

Which all entities are comes under RBI Integrated Ombudsman Scheme 2021 :

- All Commercial Banks, Regional Rural Banks, All Scheduled Primary (Urban) Cooperative Banks and Non-Scheduled Primary (Urban) Co-operative Banks with deposit size of Rs. 50 Crore as on the date of the audited balance sheet of previous F.Y

- All Non Banking Financial Companies (NBFCs) : which are authorised to accept deposits

Or

With an asset size of Rs. 100 Crore and above as on the date of the audited balance sheet of previous F.Y

- All system participants as define under the scheme

- UPI wallets companies which are authorised by RBI

On what grounds we can complaint in RBI Integrated Ombudsman Scheme :

The Banking Ombudsman can handle complaints regarding the following issues in banking services:

- Delay or non-payment of cheques, drafts, bills, etc.

- Refusal to accept small denomination notes or coins without a valid reason

- Delay or non-payment of inward remittances

- Delay or non-issuance of drafts, pay orders, or bankers’ cheques

- Failure to adhere to prescribed working hours

- Failure to provide promised banking facilities (excluding loans and advances)

- Delay or non-credit of proceeds, non-payment of deposits, or non-compliance with Reserve Bank directives regarding interest rates on accounts

- Complaints from Non-Resident Indians (NRIs) regarding remittances, deposits, and other banking matters

- Unjustified refusal to open deposit accounts

- Levying charges without adequate prior notice

- Non-adherence to Reserve Bank instructions on ATM/Debit card or credit card operations

- Delay or non-disbursement of pensions (if caused by the bank’s actions)

- Refusal or delay in accepting tax payments as required by the Reserve Bank/Government

- Delay or failure in issuing or servicing government securities

- Unilateral closure of deposit accounts without sufficient notice or reason

- Refusal or delay in closing accounts

- Non-compliance with fair practices code or banking commitments to customers

- Non-compliance with Reserve Bank guidelines on recovery agents

- Violation of Reserve Bank directives on banking or other services

- Complaints related to loans and advances, such as non-compliance with interest rate directives, delays in loan processing, unjustified loan application rejections, and non-adherence to fair practices codes

- Non-compliance with any other Reserve Bank directions or instructions specified from time to time.

- The Banking Ombudsman can also address other matters specified by the Reserve Bank.

How to file complaint against Banks, NBFCs or Digital Payment wallets

Before raising your dispute to the Banking Ombudsman, you must ensure the following situations:

- If you haven’t received a response from your bank within one month after they received your complaint.

- If your bank has rejected your complaint.

- If you are not satisfied with the reply given by your bank.

The Banking Ombudsman can help address your concerns and provide assistance in these circumstances.

There are three ways to raise your dispute to the Banking Ombudsman.

- By submitting your physical complaint to the Reserve Bank of India : You can submit a physical complaint letter to the nearest RBI office of your city.

- Through registered post : If no RBI office is available nearby, you can post your complaint letter by registered post to the RBI office of your zone. Address and Phone number details of all RBI Ombudsman office is available in the link https://rbi.org.in/Scripts/AboutUsDisplay.aspx?pg=BankingOmbudsmen.htm

(Complaint letter format is available in the link)

- Raise complaint online : You can raise complaint online using official RBI’s Complaint Management System link <https://cms.rbi.org.in>

How to file online complaint against Banks, NBFCs, Digital wallets | Process to raise online complaint in RBI Banking Ombudsman

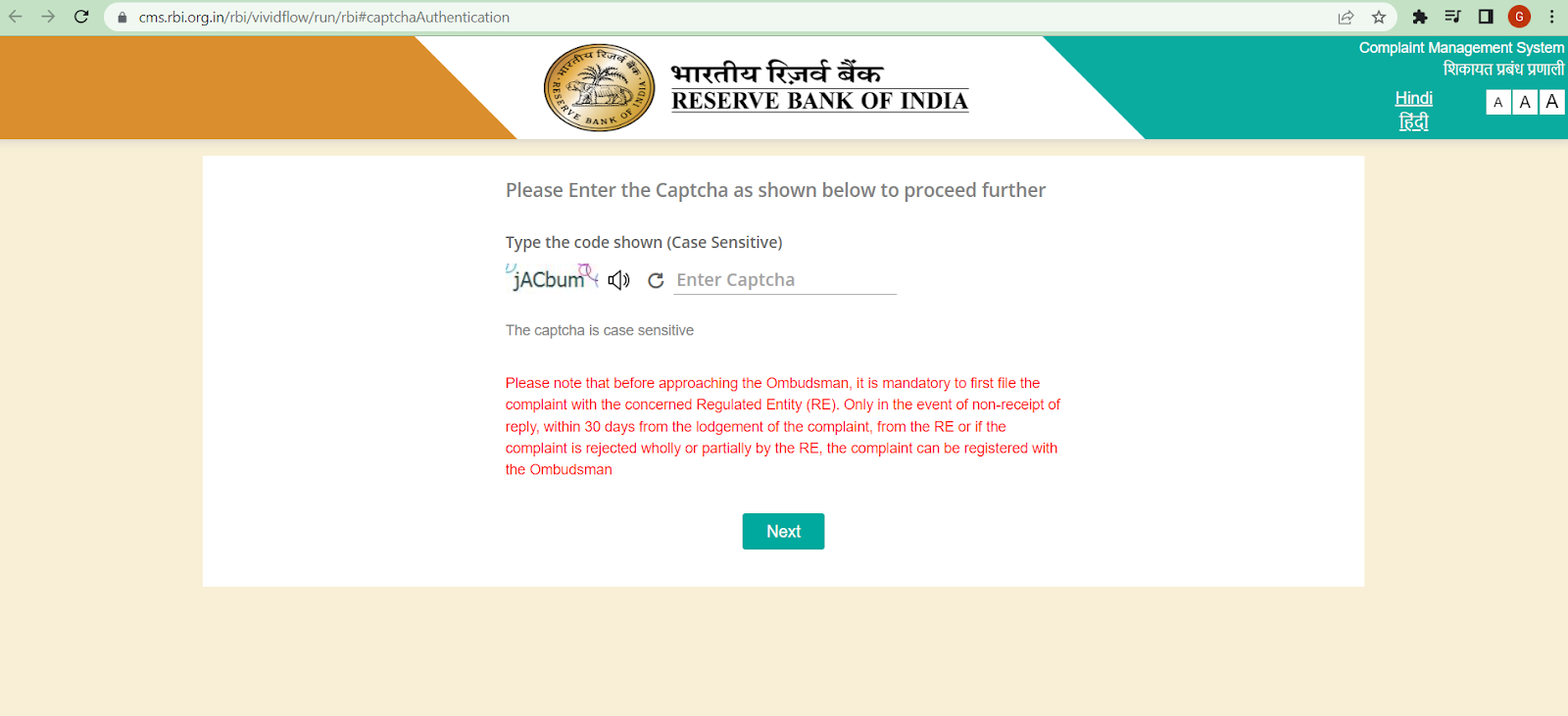

- Visit official website of RBI <https://cms.rbi.org.in>

This link is also known as RBI Complaint Management System (RBI CMS portal) link.

- From the right hand side you can choose language in Hindi or Engish

- Click on “File a complaint”

- In next page enter captcha code , then click on the next button

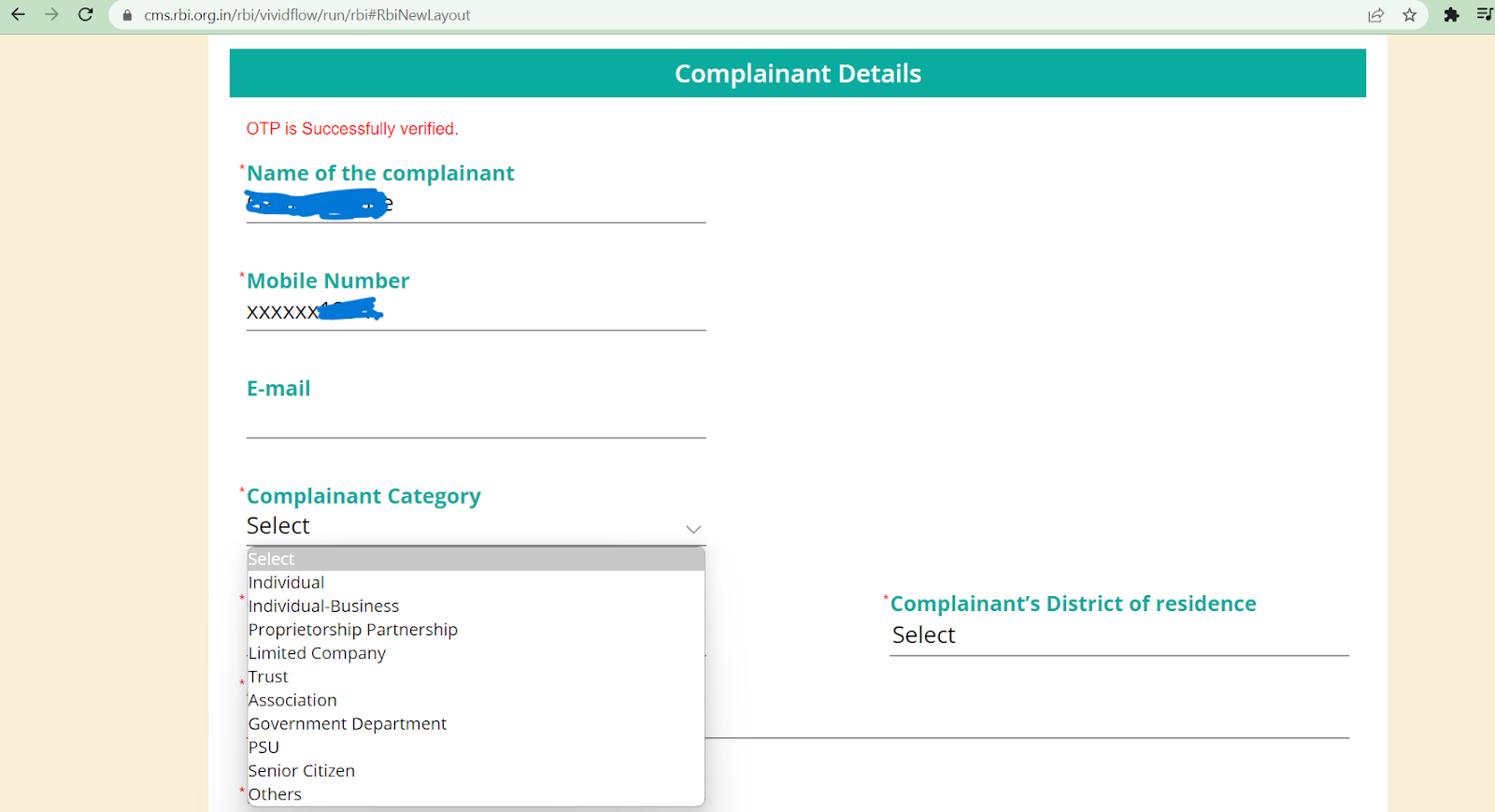

- In the next page Enter the complainant details, like “Name and Mobile Number” of the person who is registering the complaint.

Then click on Get OTP and enter the OTP and Validate and proceed.

- Now on Complainant Details Page Fill the Name of complainant, Mobile no. , Email Id

Complainant Category : select your category from dropdown menu (e.g Individual, Proprietorship partnership etc.)

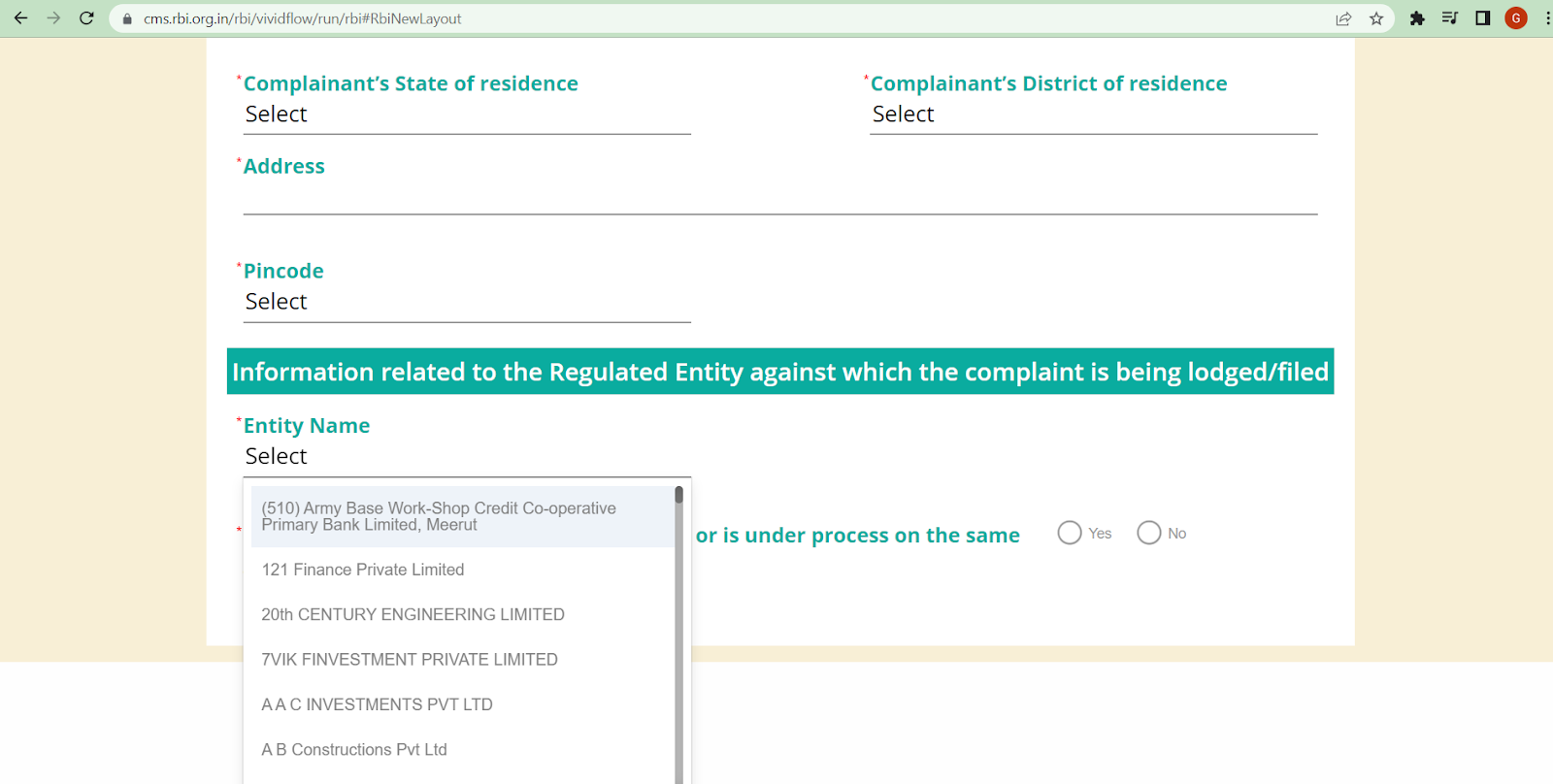

Enter State , District, Address and Pincode.

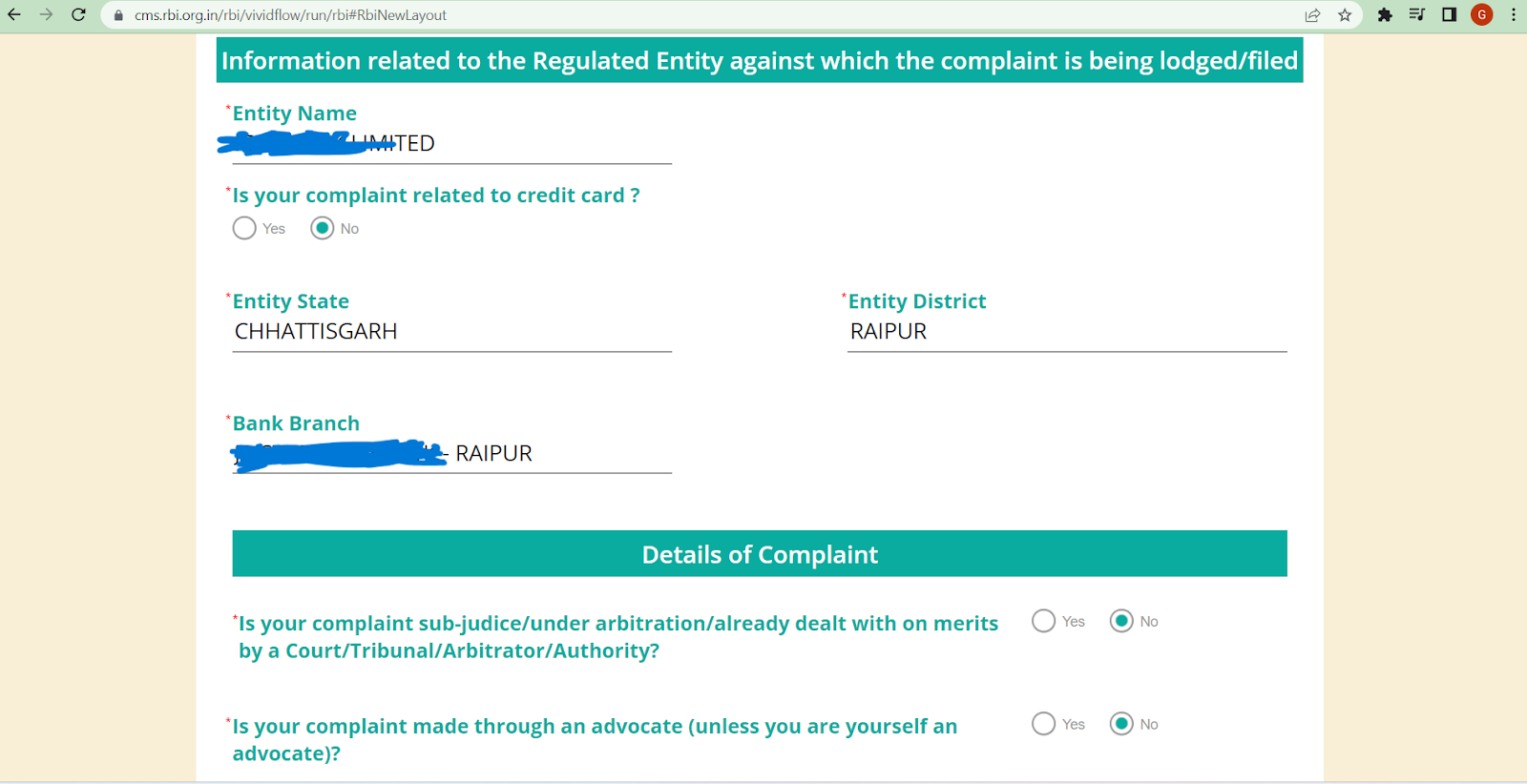

- In “Information related to the regulated entity against which complaint is being lodged/filed

Enter Name of your Bank/ NBFC/ Digital wallet in Entity Name dropdown

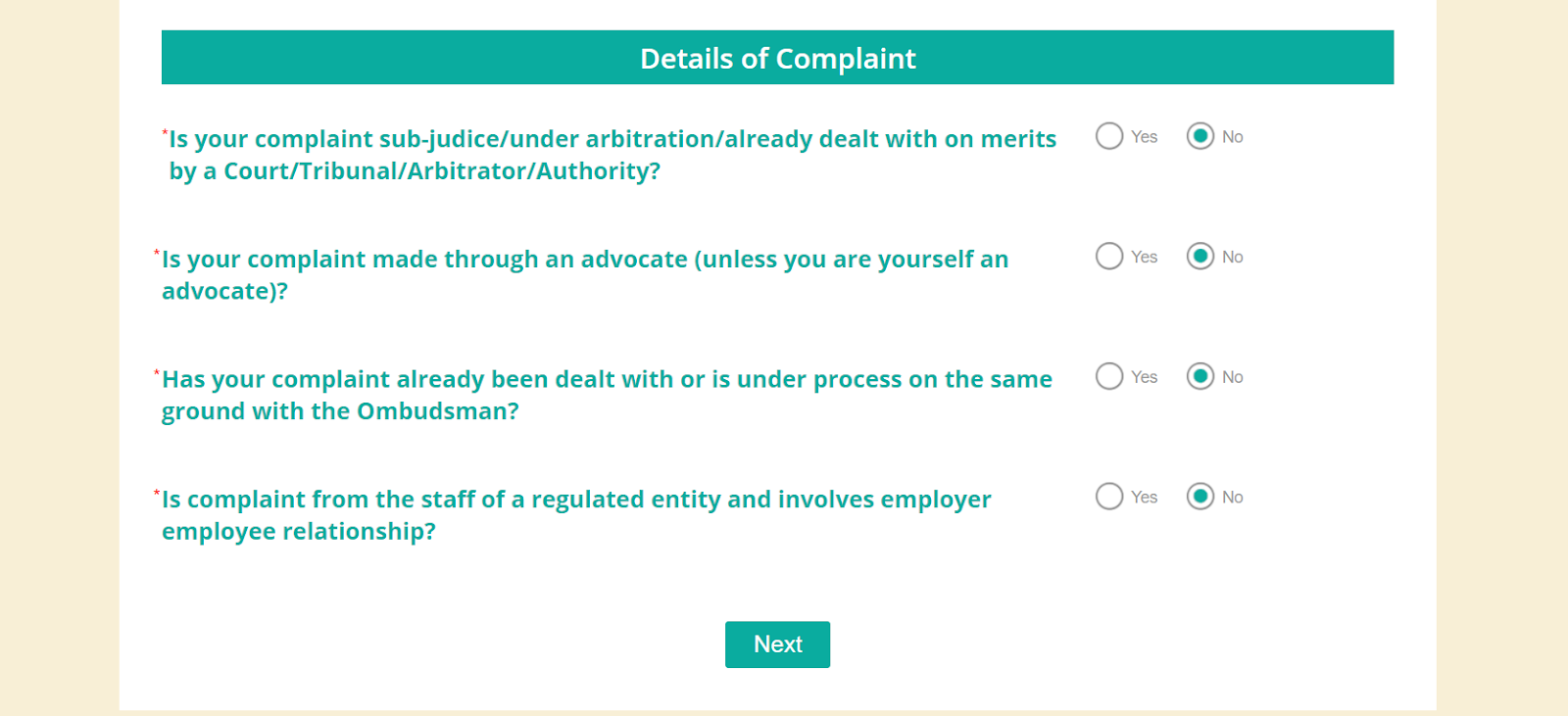

- Details of Complaint

Choose Yes or No, depending upon your case.

Please ensure that Ombudsman will reject the complaint if

- The case is already filed or a decision is pending in Court/ Tribunal/ Arbitrator/ Authority.

- Complaints have already been registered in the Ombudsman on the same ground. This is applicable for both closed and Under process complaints on the same issue.

- If a complaint from the staff of a regulated entity and employee- employer relationship is there.

Choosing appropriate option , then click on NEXT

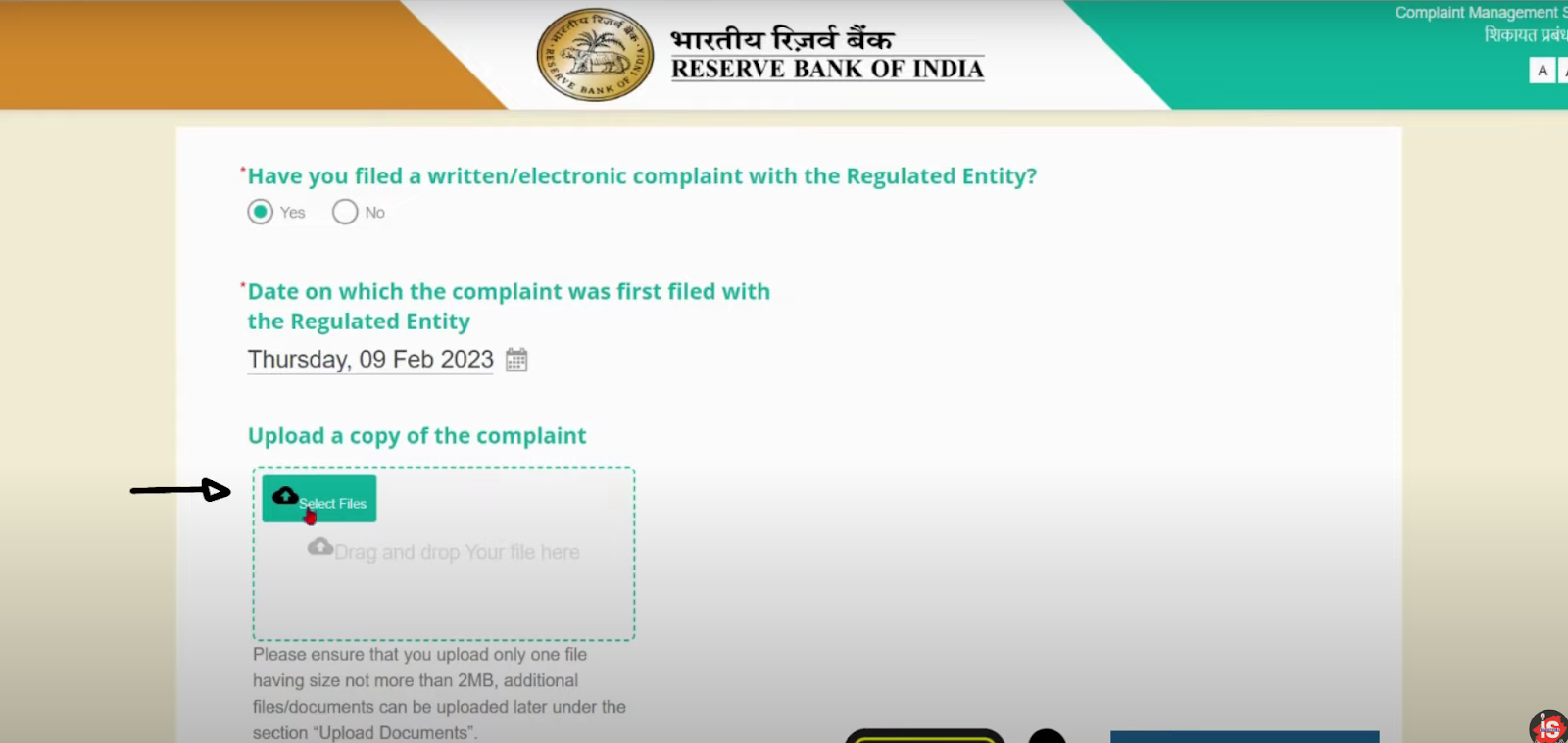

- Have you filed a written complaint with the regulated entity?

Choose YES. (You must raise request to your Bank before 30 days of raising your complaint in Ombudsman Portal)

Select Date on which you had registered your complaint in your Bank.

Upload copy/ Screenshot of your complaint in UPLOAD option

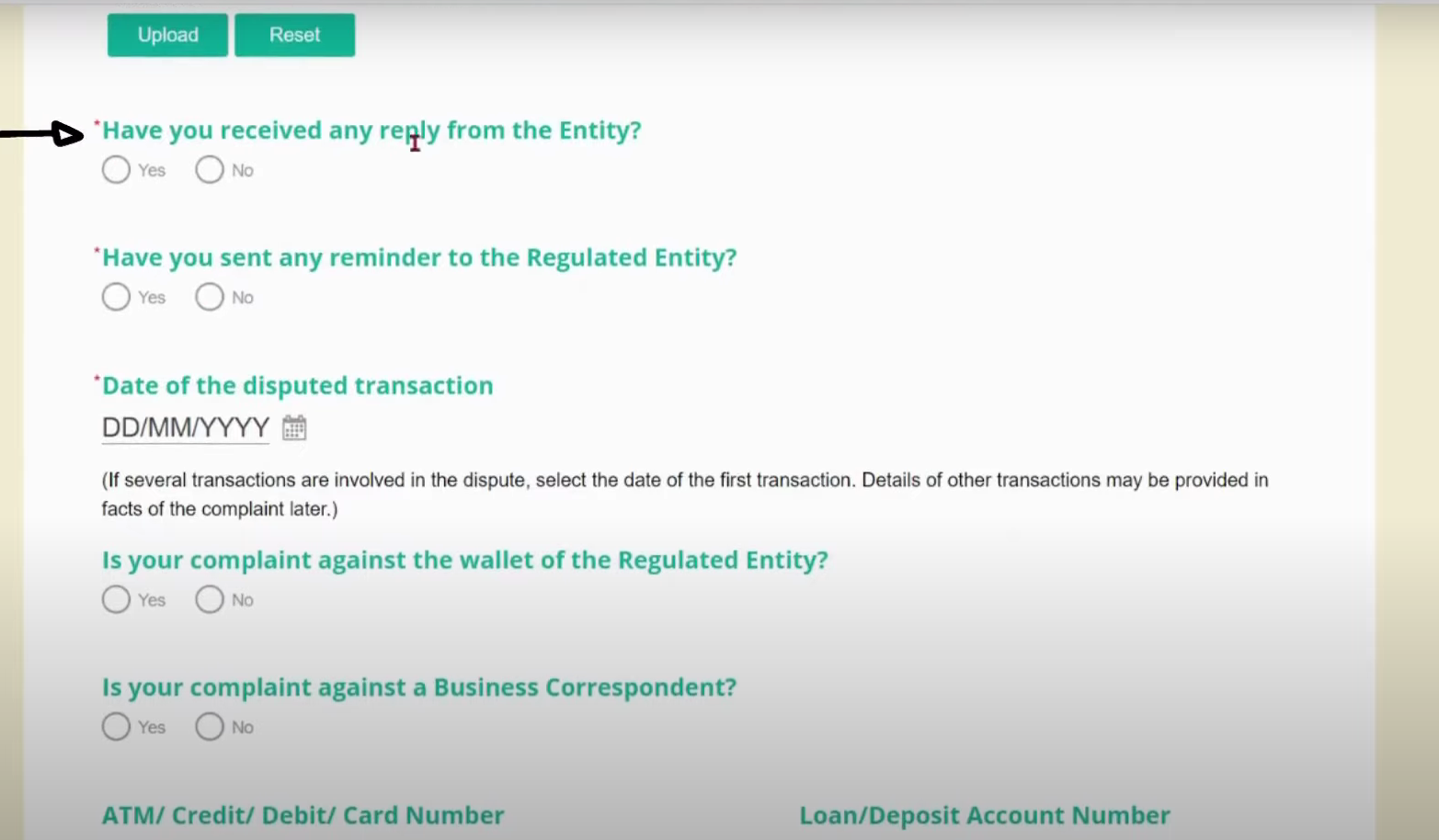

- Enter YES or NO in “Have you received any reply from the Entity” filed and Have you sent reminder to the regulated Entity (Bank).

Enter Date of Dispute in DD MM YYYY format

Is your complaint against the wallet of your regulated entity – Choose Yes/ No

Is your complaint against Business Correspondent – Select YES/ No

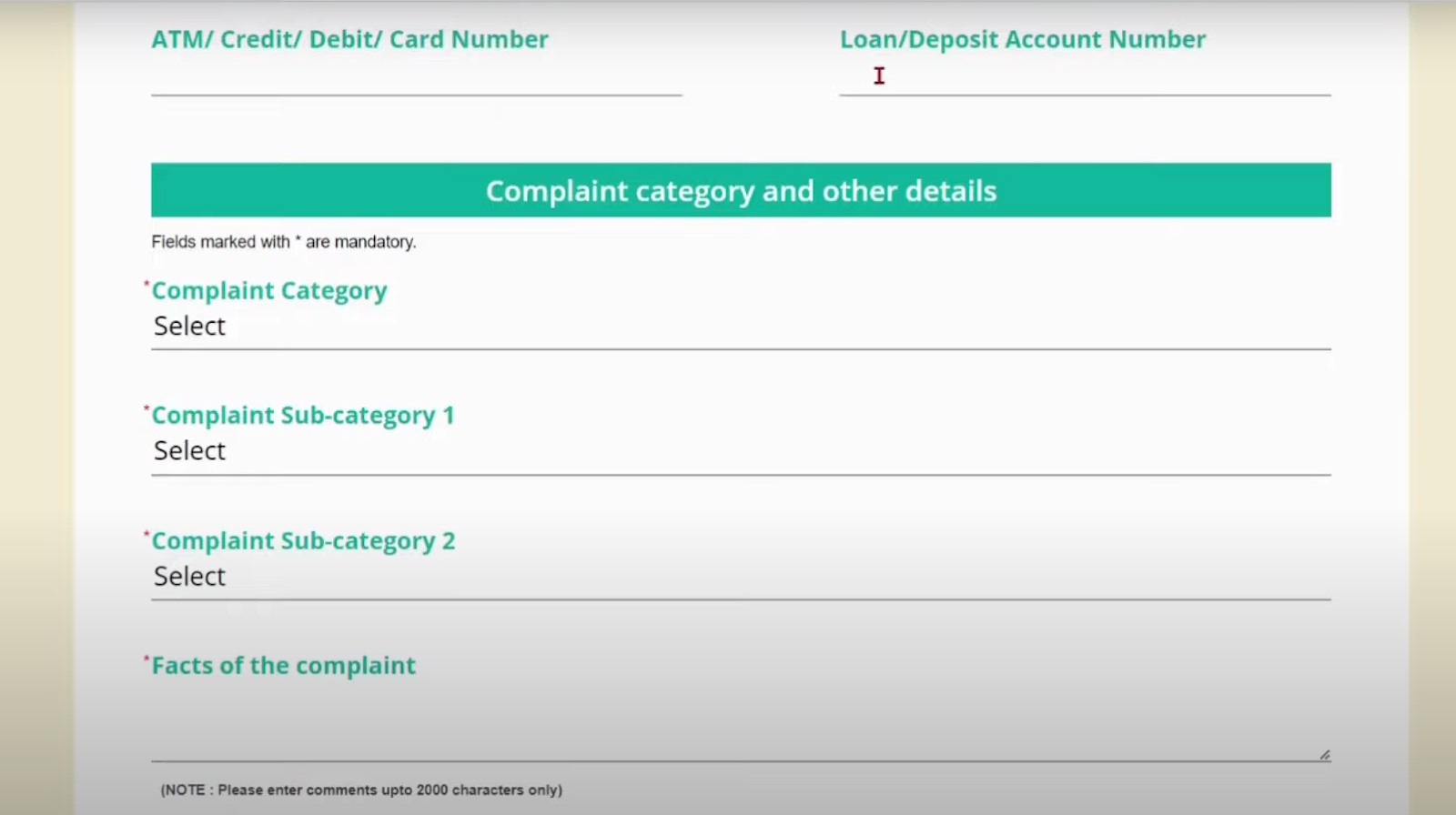

Enter ATM / Credit/ Debit card number (if your request belongs to card)

Enter Loan/ Deposit Account number : Enter your Loan/ FD/ Account number against which you want to raise a complaint.

- Complaint Category and Other details

Select the Complaint Category of your request for example ATM card, Credit Card, Loan , Other product and services etc.

Choose Complaint Sub category 1 & Sub Category 2.

(It depends upon the type of request you are raising)

Facts of Complaint : This is very Important Field of the application

In this field you have to enter all your grievances in short.

Write all important details related to your case. Ensure to write all concerns within 2000 characters only.

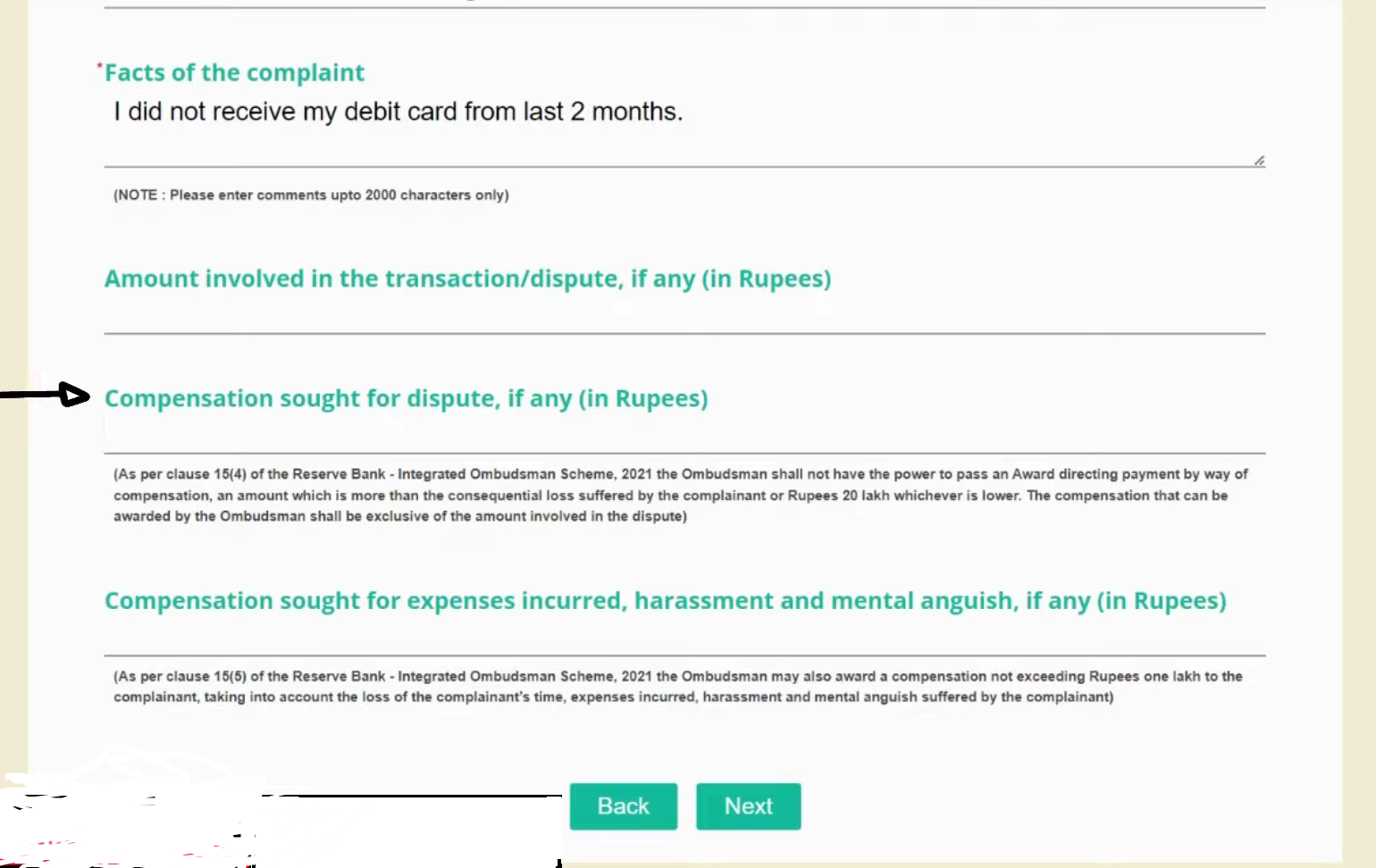

- Write amount of disputed transaction.

Compensation amount if any : If your request is severe and you need compensation against your losses, then you can ask for compensation, an amount which will be more than your loss or Rs. 20 Lakhs which is lower.

Compensation sought for expenses,harassment and mental anguish : Compensation can be asked upto Rs. 1 Lakh considering your expenses incurred, harassment, mental anguish.

(Please note that compensation can only be awarded by Integrated Banking ombudsman if compensation is justifiable on the ground of the complaint)

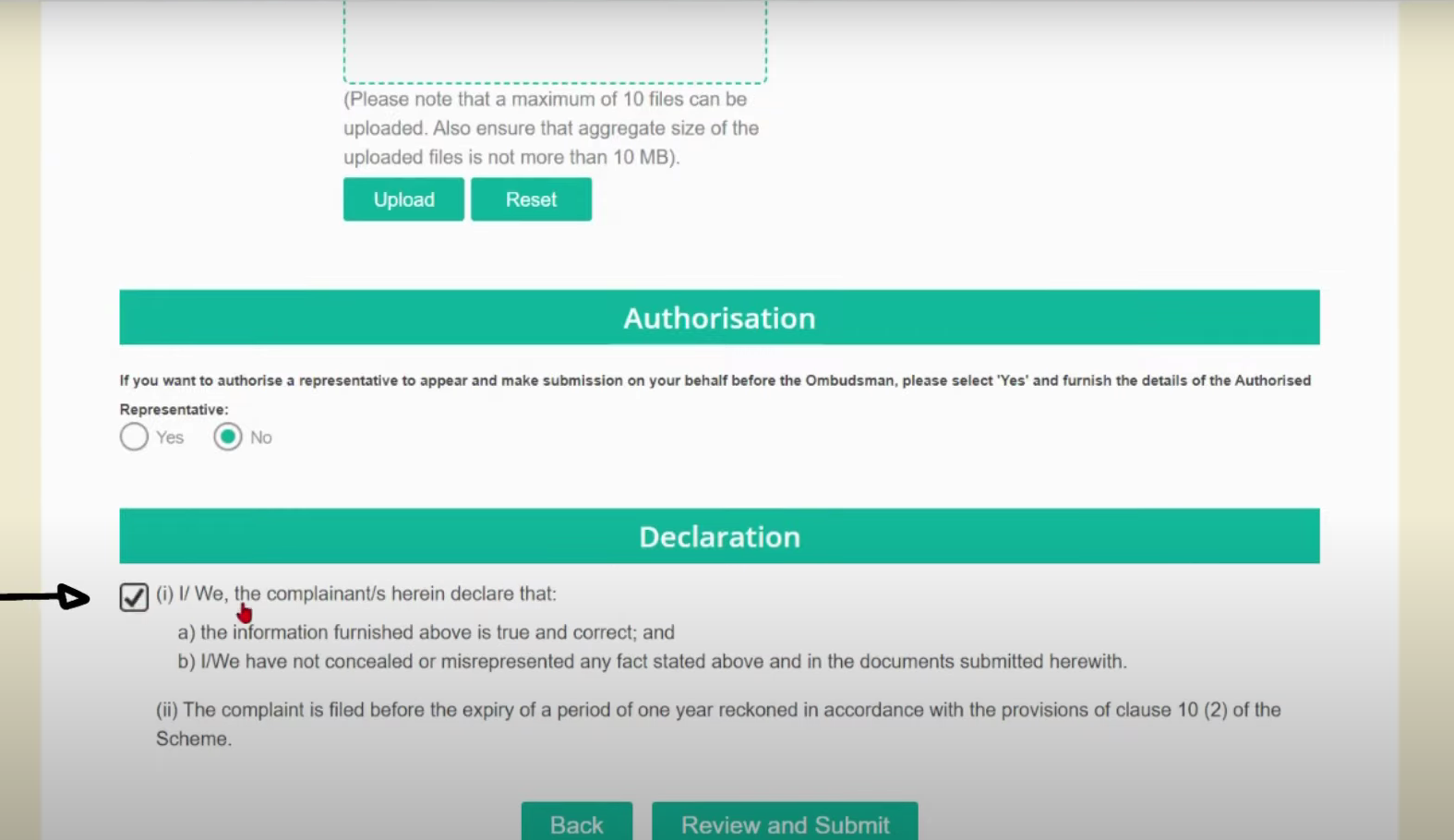

- Upload details : Upload any details , Supporting documents, Screenshot related to your complaint.

Authorisation : If you want to authorised someone to make submission on your behalf then select YES otherwise select NO

Declaration – Tick on the field in declaration part.

Then click on Review and submit option.

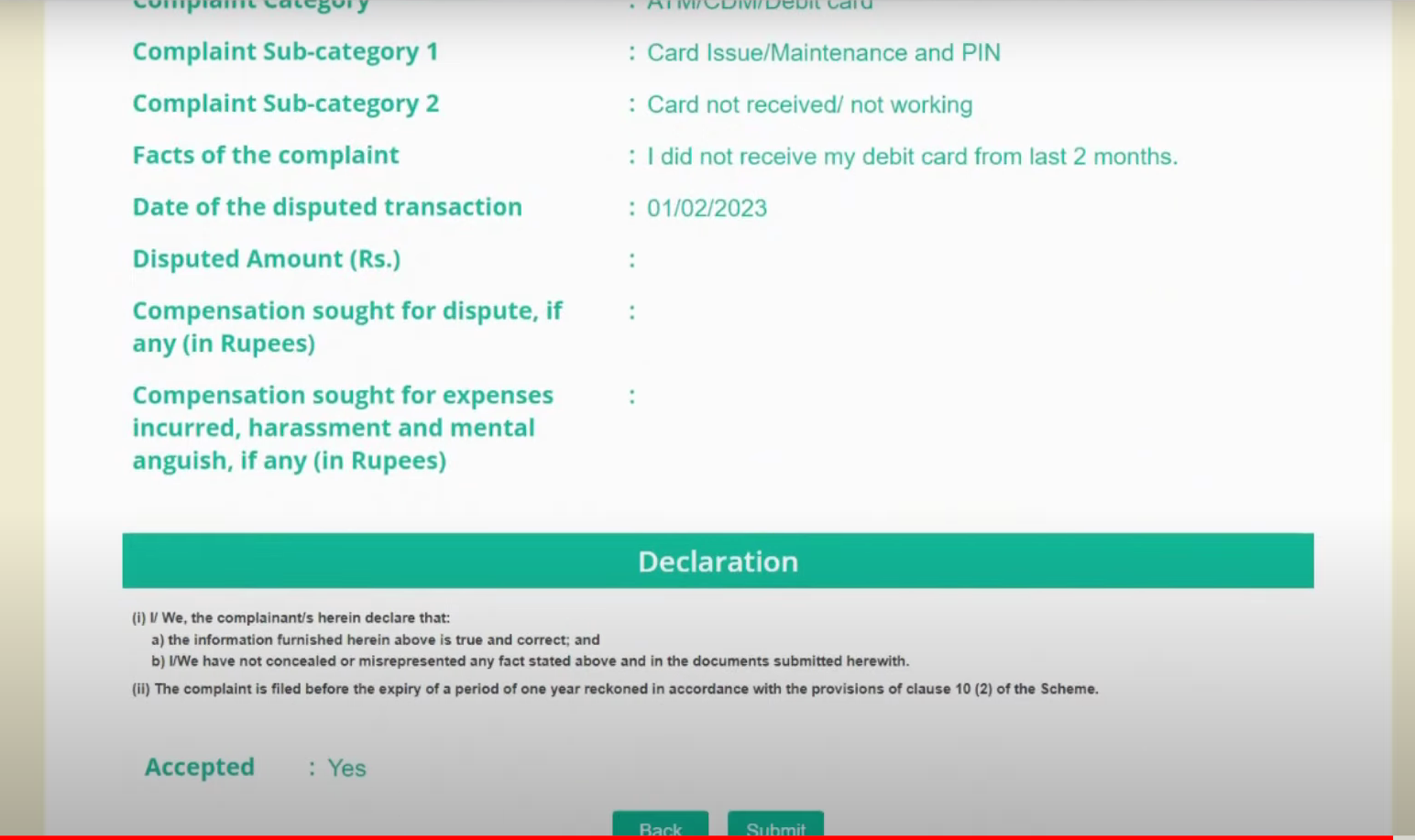

- Review all details filled are correct, If you want any change your can modify the details from previous pages.

Once you are confirmed about the correctness of the details, Click on the Submit button.

Your request will be successfully submitted to the Integrated Banking Ombudsman portal.

- Check your email for the Complaint reference number. Using this reference number you can track the status of your request in future.

FAQ – RBI’s Integrated Ombudsman Scheme

How can I file a complaint with the banking ombudsman?

To file a complaint, visit the official website of the banking ombudsman and follow the online complaint process outlined on their platform.

What documents do I need to provide when filing a complaint?

You may need to provide copies of correspondence with the financial institution, bank statements, loan agreements, or any other relevant documents supporting your complaint.

How long does it take to resolve a complaint with the banking ombudsman?

The ombudsman aims to provide a resolution within 30-90 days from the date of filing the complaint, depending on the complexity of the case.

What are the rights and responsibilities of consumers when filing a complaint?

Consumers have the right to be heard and have their grievances addressed, while also being responsible for providing accurate information and cooperating during the investigation process.

What are the benefits of the Integrated Ombudsman Scheme?

A: The scheme offers simplified complaint resolution, increased accessibility through the online platform, uniform standards for dispute resolution, enhanced consumer confidence, and timely resolution of grievances.

We’ve put our best efforts into providing detailed information in the article, If you have any questions or need help with a specific case regarding the Banking Ombudsman Scheme, feel free to reach out to our Bank Assist India Team. We’re here to guide you through your case and assist you in finding a solution. Contact Bank Assist India

Pingback: "Guarding Your Finances: How Positive Pay System by RBI is Changing the Game" - Bank Assist India